Ecommerce marketplaces are gaining momentum, fast. We’re all familiar with the saying “Go where your customers are.” These days, consumers are flocking to marketplaces like Amazon, eBay, Alibaba, Walmart, and Rakuten to do their shopping.

Last year, global ecommerce sales amounted to more than $5.7 trillion worldwide. In 2023, sales are expected to rise further, to over $6.31 trillion.

Selling on a marketplace can help build your brand, provide convenient shopping experiences for consumers, and multiply your profits. The opportunities are great, but expanding into global markets can come with complexities.

This guide will help you understand the nuances that come with global ecommerce marketplaces and look at some of the most popular marketplaces in different regions of the world.

What is an ecommerce marketplace?

A marketplace is an online ecommerce platform that hosts different products from different sellers. Companies that operate as a marketplace, like Amazon or eBay, do not own any inventory.

Types of ecommerce marketplaces

There are four main types of marketplaces:

Product-based marketplaces: Shoppers can buy physical products from various sellers. Examples include Amazon and AliExpress.

Service-based marketplaces: Clients can find and hire service providers like freelancers or independent contractors. Examples include Upwork and TaskRabbit.

Peer-to-peer marketplaces: Individuals can buy and sell products and services with each other. Examples include Etsy, Facebook Marketplace, and eBay.

B2B marketplaces: Businesses can buy and sell products and services from other businesses. Examples include Alibaba and Thomasnet.

Marketplace vs. ecommerce store

Marketplaces are convenient for consumers. In a marketplace, products are categorized and presented in a way that encourages views and sales. Ecommerce shoppers can compare options between many different brand names in an instant. To make the payment process as easy as possible, these platforms usually offer express checkout.

Ecommerce stores allow businesses to sell their products or services online directly to customers. The business is responsible for maintaining and designing the ecommerce website, processing orders and payments, and managing product shipping and delivery.

In general, an ecommerce store is owned and operated by a single business, while a marketplace platform enables multiple businesses to sell to customers in one place.

10 top ecommerce marketplaces

Amazon

eBay

Walmart

Alibaba

AliExpress

Taobao

Flipkart

Rakuten

Etsy

Mercado Libre

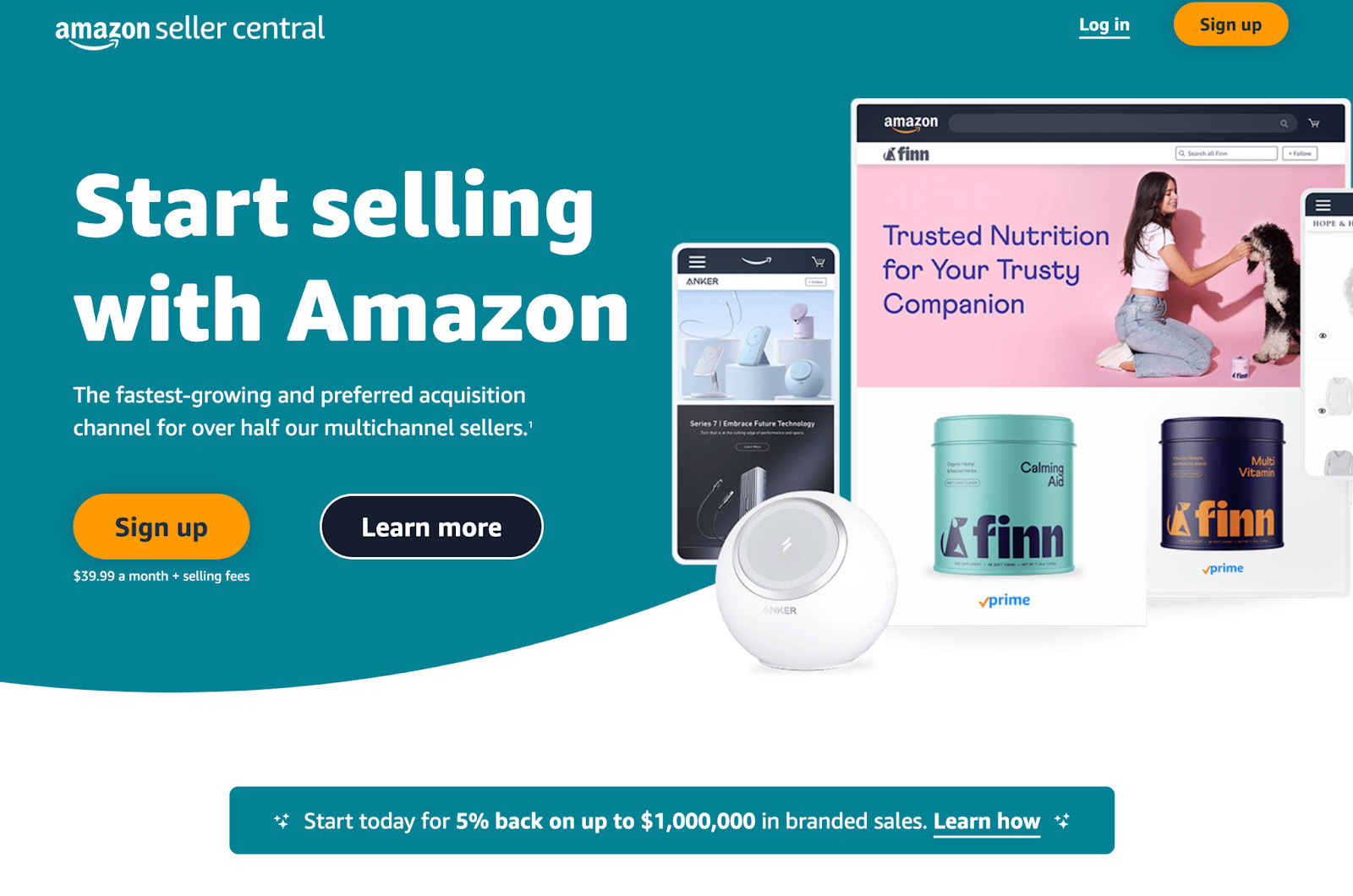

1. Amazon

The most popular ecommerce marketplace in the world is Amazon, thanks to its powerful shipping and fulfillment functions and its consistent shopping experience.

The Amazon marketplace is also the world’s second largest search engine. Incredibly, 36% of product searches take place on Amazon.

Before you can create Amazon Store content, you’ll need to register your brand using Amazon’s Brand Registry.

Once your brand is registered, you can set up your first Amazon Store. Select your theme and start to build out your pages, much in the same way you would your own website, making sure that the navigation is simple enough for customers to easily find what they’re looking for.

Monthly visits: 2.4 billion.

Fees: Varies by category, but averages 15% per sale.

Top regions: United States, Germany, United Kingdom, Japan.

Top categories: Home and kitchen; beauty and personal care; toys and games; clothing, shoes, and jewelry; health, household, and baby.

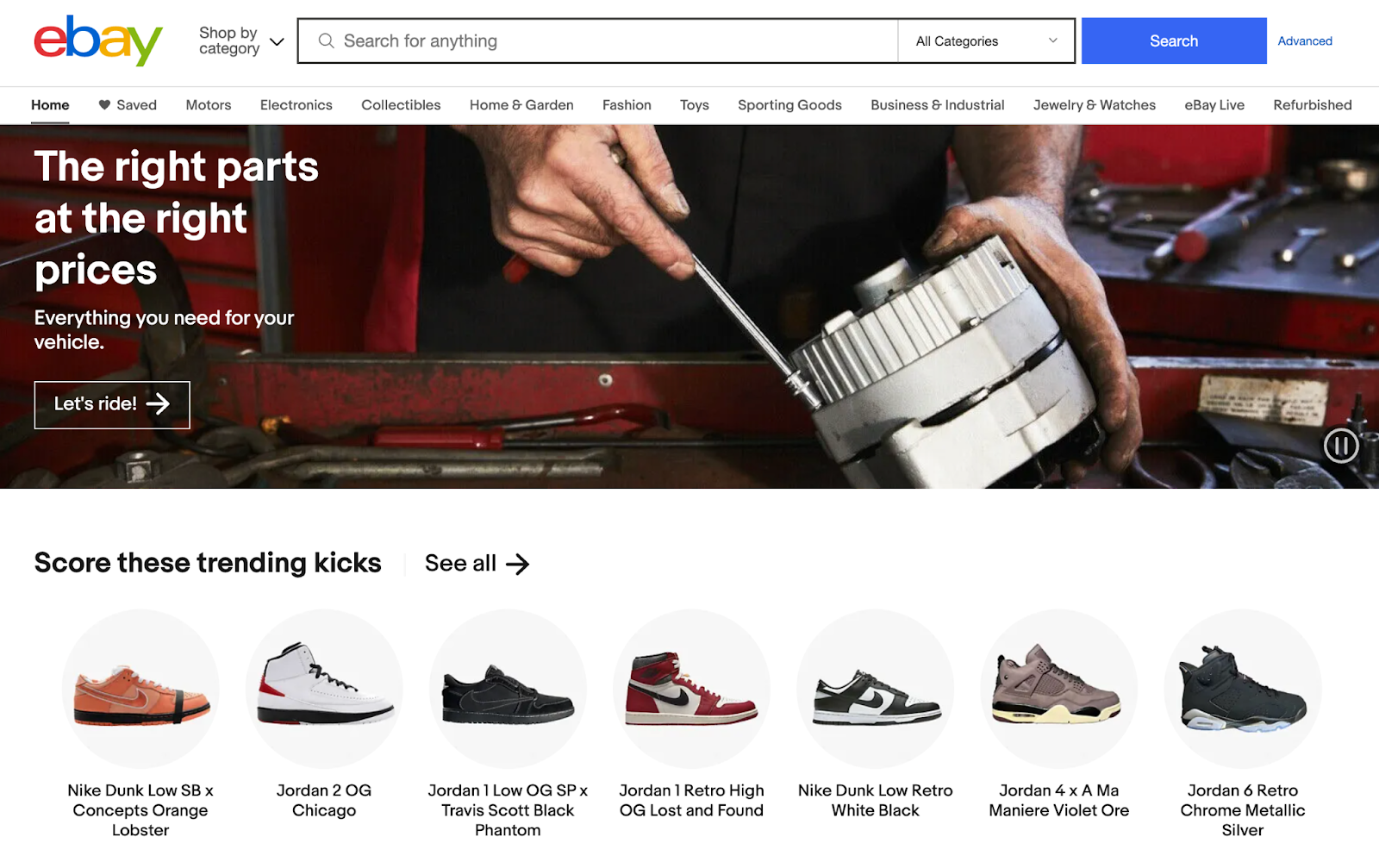

2. eBay

eBay isn’t just an online auction house for used items. Many of the products listed on eBay are actually new. The flexibility for retailers to sell new and used has allowed eBay to earn $9.89 billion in 2022.

With the eBay channel on Shopify (available in the US, Canada, Australia, the UK, and Germany), you can expand your reach to the 138 million users who shop the platform’s listings.

To sell on eBay, there are three basic steps:

Sign up for an eBay business selling account.

Set up your account policies, including shipping, return, and policy preferences.

Upload your inventory using eBay’s tools.

With eBay, there are different levels of pricing plans, each of which helps you sell more, with reduced selling fees, “promoted listing” credits, and more. You’ll need to consider a pricing structure depending on the size of your ecommerce business.

Monthly visits: 665.8 million.

Fees: Final value fee of sold item. Can be up to 14.35% of the sale price plus a 30¢ processing fee.

Top regions: United States, United Kingdom, Germany, China, Australia.

Top categories: Electronics and accessories; automotive; jewelry and watches; collectibles.

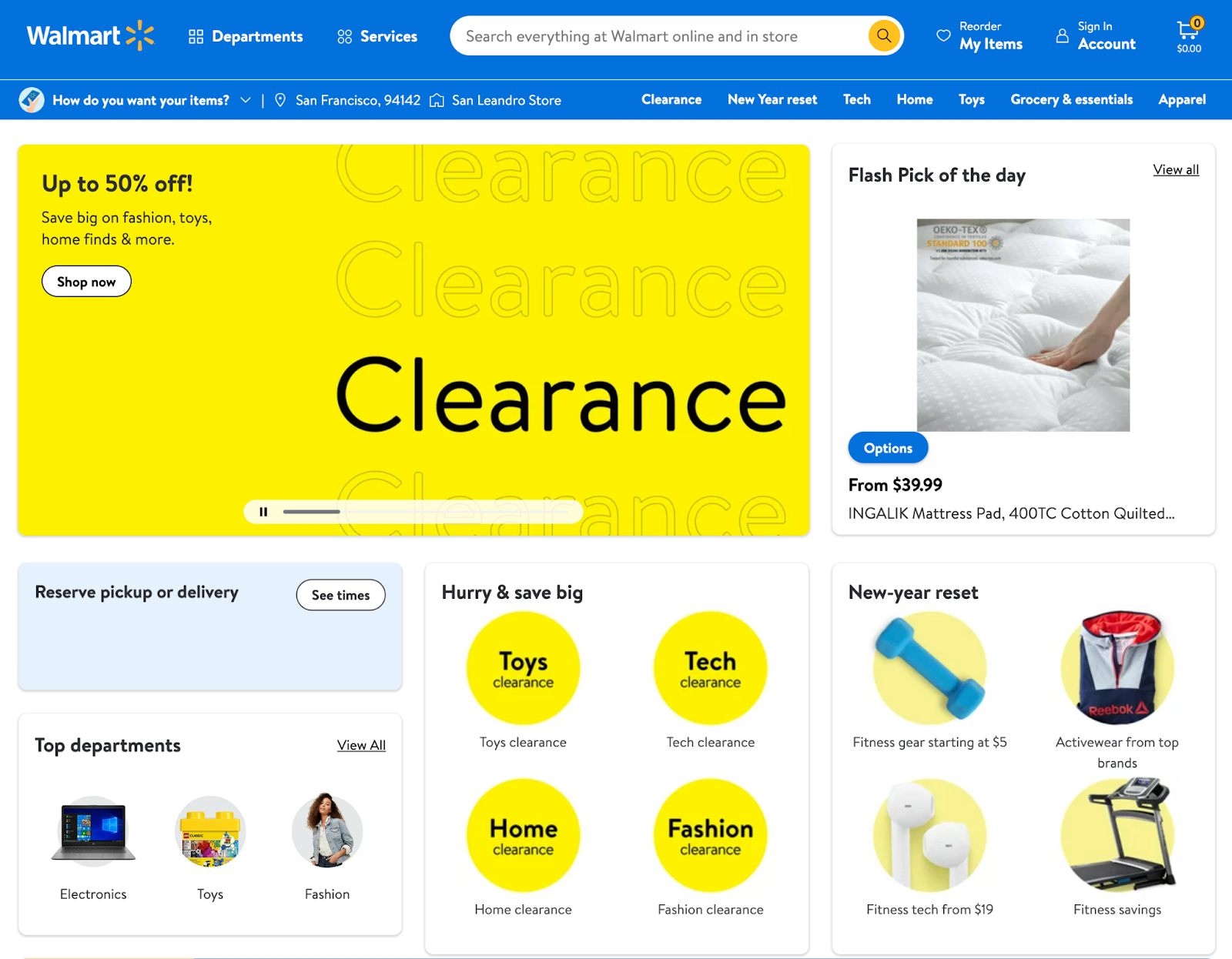

3. Walmart

Walmart is now the third-most-visited online retailer in the US, with over half a million visitors each month. In 2022, Walmart reported $47.8 billion in ecommerce sales, an 11% increase from 2021.

Walmart currently allows third-party sellers in more than 35 product categories to sell their products on its marketplace. You also don’t have to be based in the US to sell on the Walmart marketplace, since 5% of its current marketplace sellers are based outside the country.

To sell on Walmart as a partner you need to follow these five steps:

Tell Walmart about your businesses and the products you’re planning to sell.

Set up your seller account once you’ve been approved and received a contract.

Sign the Walmart Retailer Agreement and complete your seller profile.

Onboard with a choice of integration methods, add your items, and test orders.

Request for launch, where Walmart will complete a final review before you can start selling.

As part of the onboarding process, you can now connect your Shopify store with Walmart.com’s Marketplace website, if approved. The app will allow you to upload your product catalog and create listings, sync inventory, and import order details for fulfillment with Shopify. To date, this is only available for brands that are based in the US.

Monthly visits: 511.5 million.

Fees: Commission fees vary between 6% and 15%.

Top regions: United States, Canada, India.

Top categories: Electronics, toys, fashion.

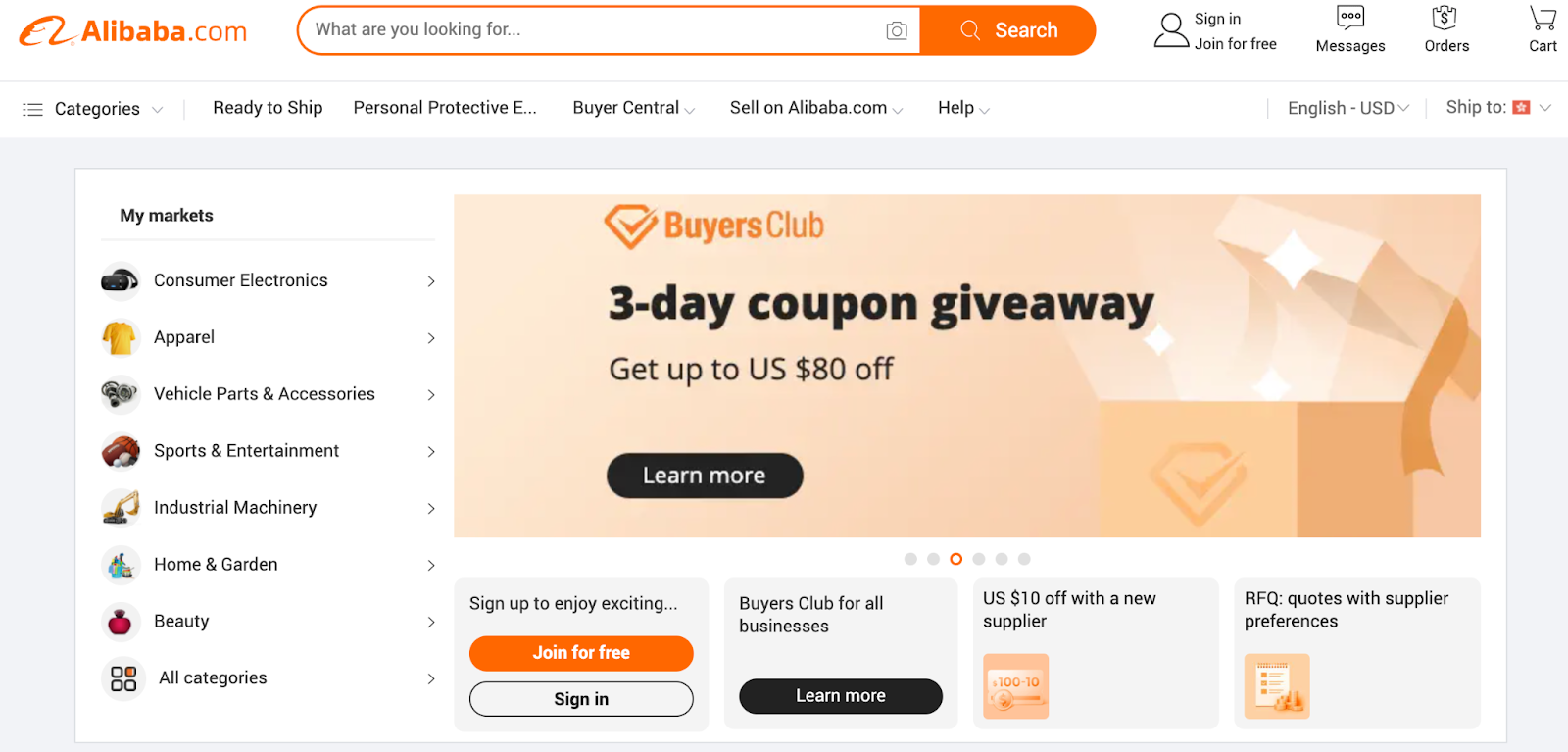

4. Alibaba

As the leading ecommerce provider in China, Alibaba is one of the best marketplaces for B2B sellers. The Alibaba Group boasts over 1.31 billion annual active consumers and reported revenue growth of $134.57 billion, a 22.91% increase from 2021’s figure.

As a business-to-business (B2B) manufacturer and wholesale supplier, Alibaba.com provides the foundation for many businesses. So if your business is about selling products to other businesses (which don’t have to be limited to China), look no further than Alibaba.com.

To start selling with Alibaba, you’ll just need to fill out a simple form to create an account.

Monthly visits: 99 million.

Fees: Seller plans start at $3,499 per year.

Top regions: China, United States, Russia, United Kingdom.

Top categories: Electronic consumer; sports and entertainment; beauty and personal care; tools and equipment.

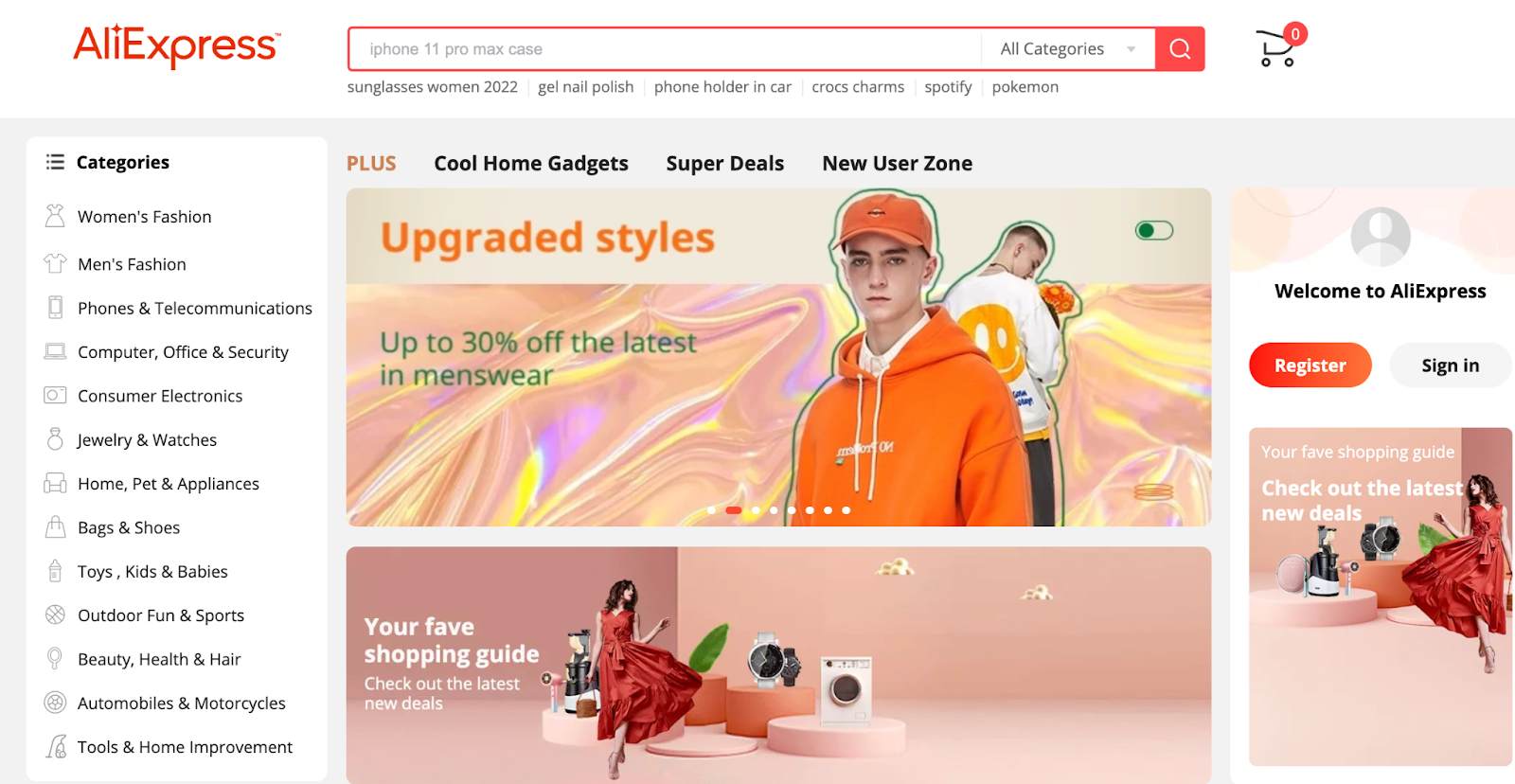

5. AliExpress

AliExpress is a subsidiary of the Alibaba Group and one of its established marketplaces in the B2C space. On its own, AliExpress pulls in over 435 million website visits a month and has over hundreds of millions of downloads of its mobile app.

What makes AliExpress a great option for many businesses is its localization—the platform is available in 18 languages in 230 countries and regions. It’s a common marketplace for dropshipping companies because many suppliers ship direct to consumer for affordable fees.

Selling on AliExpress is as easy as selling on many other platforms: create an account, submit your business information, then submit your application. After that, you can personalize your store and start selling.

Monthly visits: 435 million.

Fees: Commissions vary between 5% and 8%.

Top regions: China, Brazil, Spain, United States, France, Korea.

Top categories: Consumer electronics; health and beauty; home and garden; women’s clothing; mom and kids.

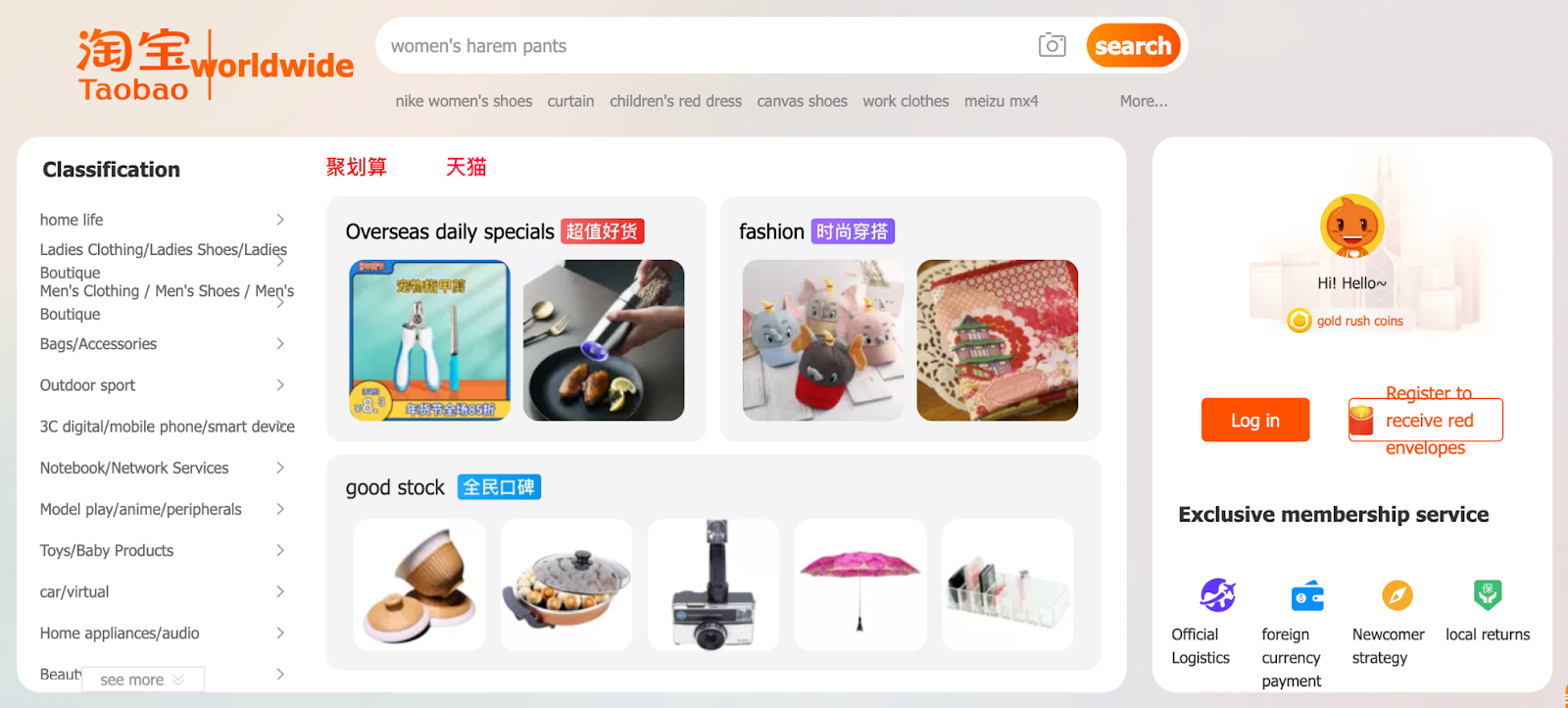

6. Taobao

Formed in 2003 by Jack Ma, Taobao is a leading ecommerce marketplace in China as of July 2022. What separates Taobao from AliExpress is that its business model is primarily consumer to consumer (C2C)—think of it as the eBay of China. As of June 2022, the Taobao app had almost 875 million monthly active users.

Monthly visits: 300.1 million.

Fees: None.

Top regions: China, Taiwan, Hong Kong, United States, Singapore.

Top categories: Women's clothing, cosmetics, jewelry, home furnishing.

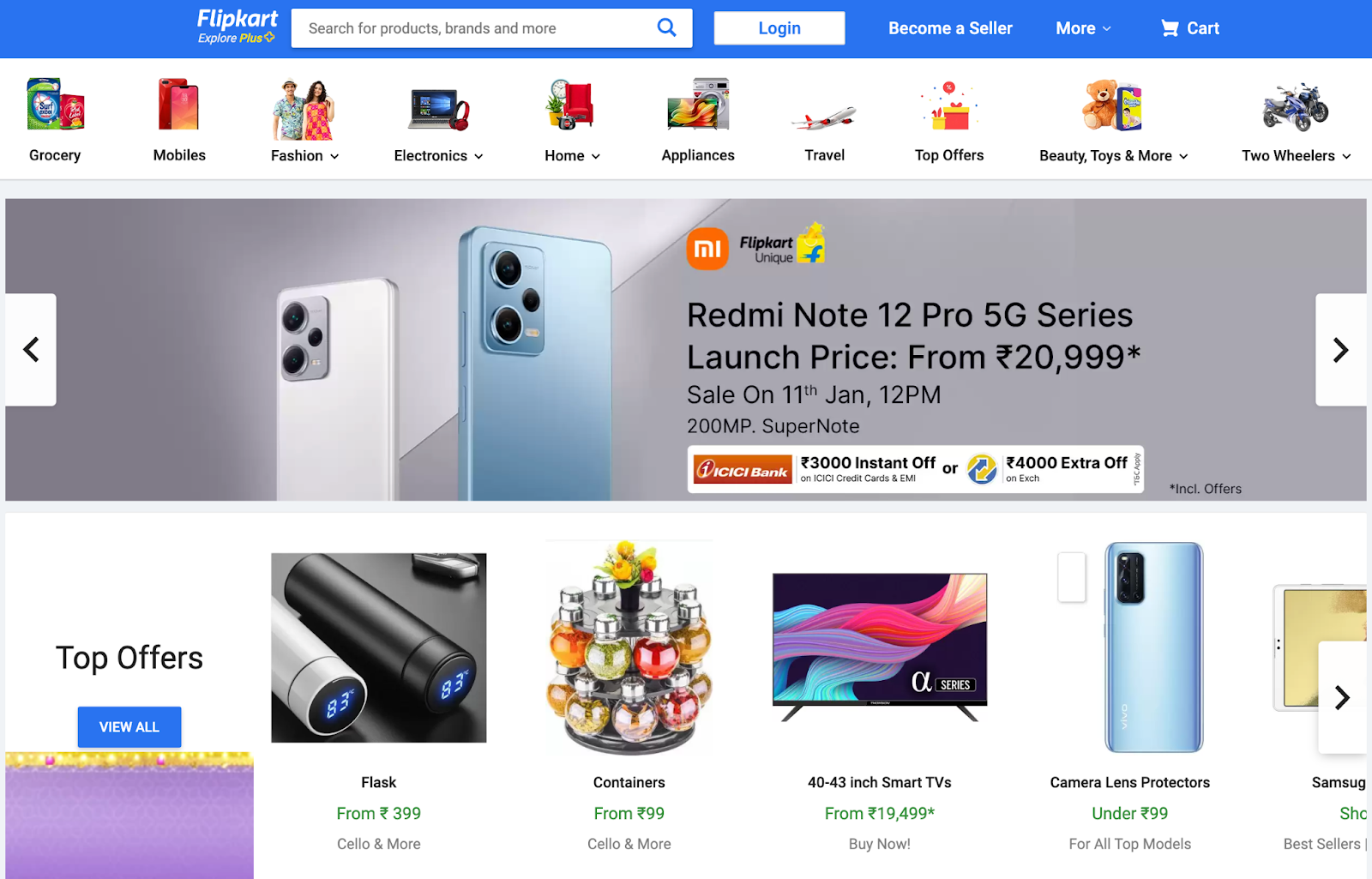

7. Flipkart

Flipkart is an ecommerce company based in Bengaluru, India, and was acquired by Walmart in 2018.

The company was founded by previous Amazon employees in October 2007, launching a proprietary product line called DigiFlip that included laptop bags and tablets, and has since expanded into other product categories like furniture, grocery, travel, and beauty.

Monthly visits: 188.3 million.

Fees: Rates vary from 2.8% to 25%.

Top regions: India, United States, United Arab Emirates, United Kingdom.

Top categories: Electronics; home and kitchen; fashion; books; and health and beauty products.

8. Rakuten

Japan-based Rakuten saw a 12% increase in gross transaction value (GTV) in Q2 2022, compared to the second quarter of the previous year, bringing in around 1.3 trillion Japanese yen. Its customer base is made up of 1.6 billion members, and products include electronics, fashion, and pet supplies.

In order to sell on Rakuten, merchants must apply and be approved. Brands can customize storefronts, which can help create your own brand identity on the platform and attract customers.

Monthly visits: 102.1 million.

Fees: Monthly fee, 99¢ listing fee per item, commission charge between 8% and 20%.

Top regions: United States, Japan, France, Canada, Taiwan.

Top categories: Electronics; home and outdoor; clothes and shoes; sports and fitness; bags and luggage; pet supplies.

9. Etsy

Another North American ecommerce marketplace is Etsy. Esty mostly serves the arts and crafts community, specializing in handmade, vintage, and collector’s items. Etsy brought in over $2.48 billion in 2022, up 35% year over year.

If you’re a craft-based small business, it makes a lot of sense to list products on Etsy—which is very easy to do (just create an account and start listing). One caveat is that Etsy charges you a listing fee, but overall, these fees are lower than some of the other marketplaces mentioned in this article.

Monthly visits: 566.4 million.

Fees: 6.5% transaction fee of the price displayed.

Top regions: United States, United Kingdom, Canada, Germany, France.

Top categories: Jewelry; wedding items; party supplies; vintage items; clothing; home and living.

10. Mercado Libre

Mercado Libre is a massive online retailer and payments ecosystem in Latin America. Founded in 1999, Mercado Libre has become Amazon’s largest competitor in the country.

According to its Q3 2022 letter to shareholders, the ecommerce marketplace generated $2.7 billion in ecommerce revenue in the quarter alone, a 60.6% year-over-year increase. All three major markets posted solid gross merchandise volume (GMV) growth in the same quarter: Brazil (+20%), Argentina (+87%), and Mexico (+23%).

Monthly visits: 27.7 million.

Fees: Varies between country and category, but can be upward of 16% per order.

Top regions: Argentina, Mexico, Chile, Colombia, Uruguay.

Top categories: Smartphones; home and garden; sporting goods; fashion; and electronics and accessories.

Benefits of selling on ecommerce marketplaces

Some benefits of selling on most ecommerce marketplaces include:

Gaining access to millions of customers. Where do customers often go to start their shopping? Marketplaces. Listing your items on eBay, for example, gives you access to a customer base of 187 million. Walmart now sees 410.5 million monthly visits, and Amazon has over 2.4 billion visits per month.

Visibility and brand awareness. Marketplaces can also help you access new audiences. One concern of brands is that people will buy their products on marketplaces instead of on their own sites. The fact is, without visibility in marketplaces, you may not get many of those customers in the first place. The next move could be to build a strong relationship with new customers and help transition them from a marketplace to your own website.

Gaining trust. When you sell on a marketplace you are also the beneficiary of its marketing and brand building. Consumers tend to trust marketplaces, which automatically help your online business have a built-in established level of trust.

Testing ground. Do you want to know what people are willing to spend on a product? Do you have a product surplus or want to introduce a new product? Use a marketplace instead of your own online store to test out what works and what doesn’t.

Going global. Most marketplaces operate internationally. When selling your products on a country-specific marketplace you can expand your reach to other countries with minimal effort.

Tips for selling on global ecommerce marketplaces

1. Choose the right ecommerce marketplace for your brand

As tempting as it might be to list your products on every single marketplace, you want to focus only on platforms that are a good fit for your products. Each marketplace has its own nuances, rules, and audience.

Some might take a commission on every sale. Others might charge you a listing fee. Either way, you’ll need to weigh the costs and benefits of getting access to a certain marketplace’s customers.

Here are a few characteristics of ecommerce marketplaces that will help you narrow down your choices:

Products. Some marketplace retailers may be more niche than others or may not allow the sale of products in particular categories (like medical devices). Research your potential marketplaces to see if your product can sell there.

Marketplace fees. It’s not just the selling and transaction fees and the commission structure you’ll need to contend with. Remember to check out shipping costs (if they’re not included), as well as any chargeback or refund fees.

Customer location. If you’re primarily looking to sell online in the United States, it makes sense to use a marketplace US customers are familiar with, such as Amazon or eBay. If you’re looking to sell to customers in Asian markets, then you’d be better served by Alibaba or Tmall.

Competition. While listing on a marketplace should help you get ahead of those who don’t (remember: potential customers do their initial product searches on marketplaces), you’re up against hundreds, sometimes thousands, of other vendors.

Consider whether you want to search for a more niche marketplace before going head-to-head against other vendors on big marketplaces.

With this in mind, you should be able to have a better idea of what you’re looking for in an ecommerce marketplace.

2. Use advertising strategies

Advertising on marketplaces like Amazon is on the rise. Some 57% of ecommerce marketplace operators use display advertising to engage buyers through marketplaces. Each platform has its own rules and guidelines for advertising, but if you plan to pay for placement, prepare by doing the following:

Prep inventory. Running ecommerce marketplace ads can lead to a quick boost in online sales. Set up an automated inventory management system to keep stock levels balanced. Make sure your fulfillment center is staffed properly or you’re working with a 3PL.

Create a pricing strategy. You’ll be competing heavily on price when advertising in a marketplace. Marketplaces often run on a pay-per-click model. Costs vary widely.

Craft product content that’s informational, helpful, and customer friendly.

It’s necessary to consider profitability trade-off. Conduct a cost-benefit analysis of the addressable ecommerce market that ads will reach on a specific marketplace. Understanding early the level of margin you’ll accept can help maximize ad spend.

3. Optimize product listings

Once you have a marketplace to display your products, treat product listings like your own website. Showcase your brand and introduce products how you want. If you’re selling on multiple marketplaces, consider a management platform to manage everything at once.

Experiment with product titles and descriptions for specific search queries. Shoppers will see your title first before deciding to click on your listing or not. Each marketplace has its own ranking principles and SEO. Test and experiment with what works best to show up for select queries.

4. Offer an assortment of products

Ecommerce marketplace algorithms boost high-performing products to the top of search engines. Products that get many great reviews and get purchased repeatedly are more likely to show up for shoppers. Your offerings also shape consumer perceptions of your brand and your global marketplace performance. Consider listing top-performing products from your store versus, say, a brand new style that has zero traction.

5. Create a good customer experience

“Give global customers the same visibility and courtesy you would to local customers,” says Shelly Socol, founder of 1 Rockwell, a lead global ecommerce agency. While online selling sites may restrict certain elements like customer identities and branding opportunities, you can still create a good online shopping experience.

Socol recommends:

Offering pricing in shoppers’ home currency

Offering human-curated translations

Showing total landed cost expectations (including duties and taxes)

Showing shipping and delivery expectations

Start selling globally today

If an omnichannel brand wants to be everywhere its customers are, part of selling omnichannel includes expanding through marketplaces—often globally. Most people don’t start searching for products on Google or retail websites. They start on ecommerce marketplaces.

As you can see, there is no shortage of niche marketplaces for ecommerce brands to sell on. These websites can help you expand your brand awareness, reach new markets, and drive retail ecommerce sales.

Global marketplaces FAQ

Is Shopify an online marketplace or ecommerce?

Shopify is an ecommerce platform. It helps merchants create and manage their own online stores and connect with various sales channels, including marketplaces and social media sites.

What is an example of a marketplace?

An example of a marketplace is Amazon. It also acts as an online platform that sells products from third-party vendors. Another example is eBay, a global online auction and shopping website.

What are the advantages of using a marketplace?

Using a marketplace allows for greater visibility for businesses and access to additional customers. It also helps businesses increase their reach without building their own ecommerce site.

What are the best ecommerce marketplaces?

The best platform depends on the product you are selling and the target audience. Amazon, eBay and Etsy are some of the most popular ecommerce marketplaces.

Read more

- Back-to-School Ecommerce: Infographic & Lessons from $58.1B in Online Sales

- Warning: Most Conversion Optimization Tips Are BS (Here's Why!)

- How Beard & Blade Doubled Its Wholesale Ecommerce a Year after Replatforming from Magento

- How You Can Profit from Personalizing Content on Your Ecommerce Store

- The 1 Rule for Building a Billion-Dollar Business

- 7 Conversion Rate Optimization Experts Answer the Questions You Were Too Afraid to Ask

- Shopify vs. Salesforce Commerce Cloud

- Shopify vs. Magento 2023 — Which Platform Is Best for You?